A growing need for liquidity

Over the last 20 years, companies in the U.S. and elsewhere have remained private for considerably longer periods before seeking a liquidity event such as a sale, business combination, IPO, or other liquidity event. As a result, the need for alternative liquidity opportunities and services for stakeholders grows.

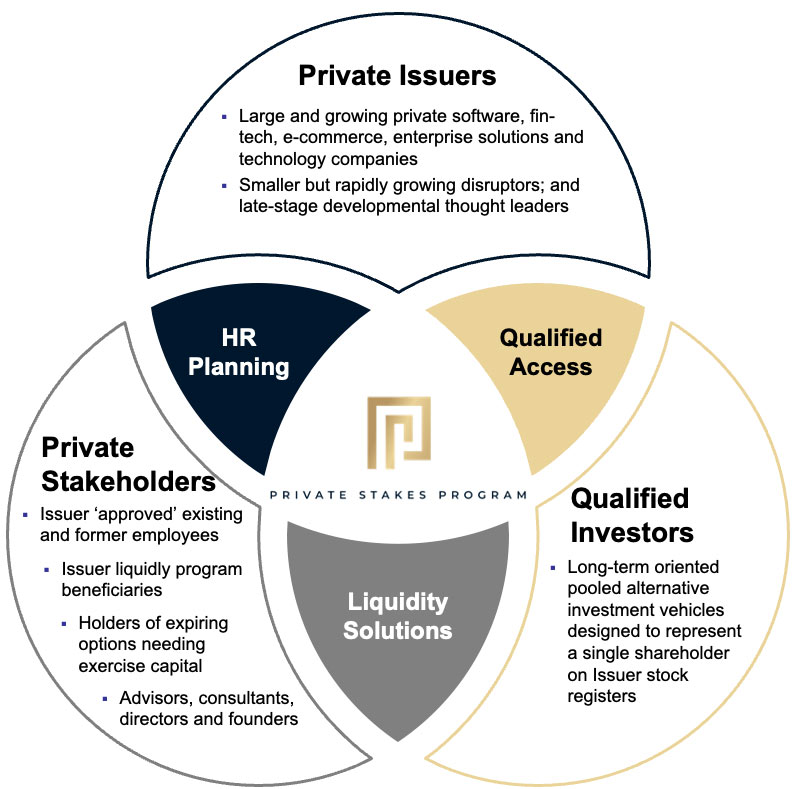

- Mutually beneficial access to financial liquidity and investment opportunities for a ‘stakeholders-only’ group of Issuers, on the one hand, and an exclusive ‘members-only’ cadre of qualified investors, on the other hand.

- An evolving landscape for private share transactions whereby our proprietary funds identify and enter into contracts with existing stakeholders of various venture-backed issuers to facilitate a transfer of private stock from the stakeholder to the fund subject to the transfer procedures and ultimate approval of the issuer.

- Because Issuers are typically remaining private for longer than in the past, often, a greater percentage of their value appreciation is captured in private over public markets.

- The availability of private capital allows many technology companies to be more selective with the timing of their initial public offerings.